I’ve heard several realtors recently say ‘This is a strange market.’ Today, a realtor characterized it as ‘goofy.’ To me, that means we’re transitioning and don’t have a clear handle on where we’re headed. What are the clues?

One is odds of selling. For the Ashe County single family housing market, the odds have gone down, overall for all homes in the market. That’s because the number of homes coming on the market this Spring has increased, which is a typical pattern. In the lower price range, enough homes are selling that it is still a buyers market. In the upper price range, the months of inventory now exceeds 6 months, and most realtors would say that means that is now a buyers’ market.

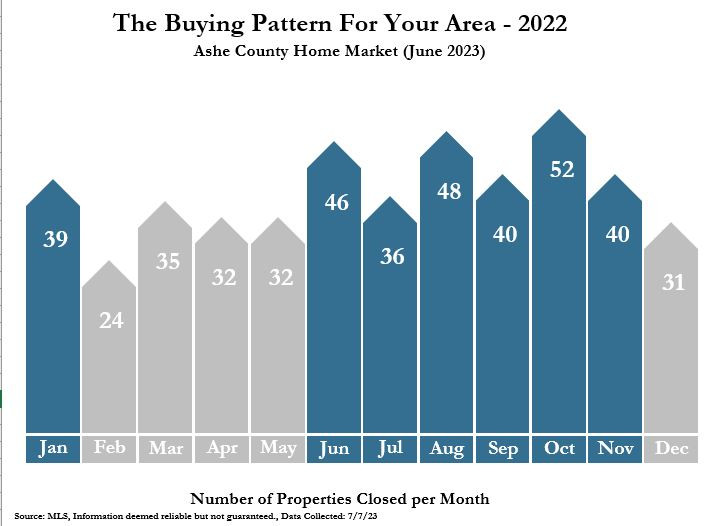

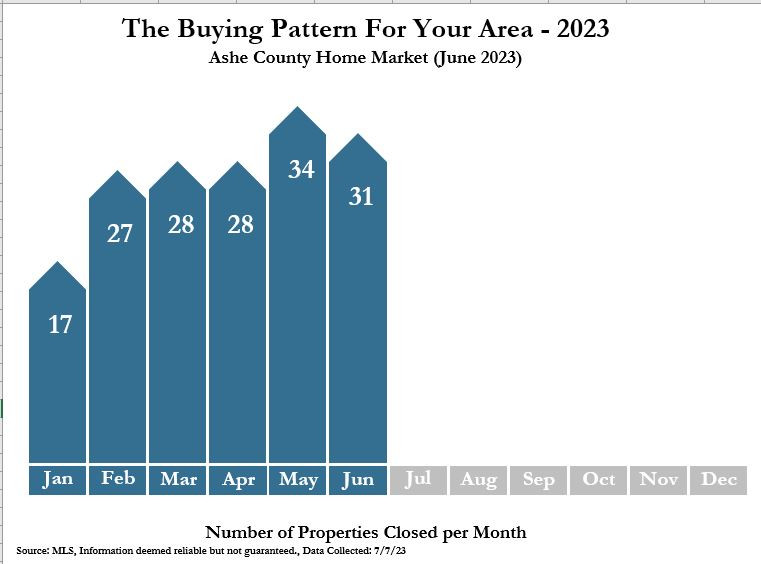

Another clue is number of homes sold. In the two Buying Pattern graphs below, you’ll see less homes are selling in 2023 than 2022. That might be an indication the market is moving toward a buyers’ market.

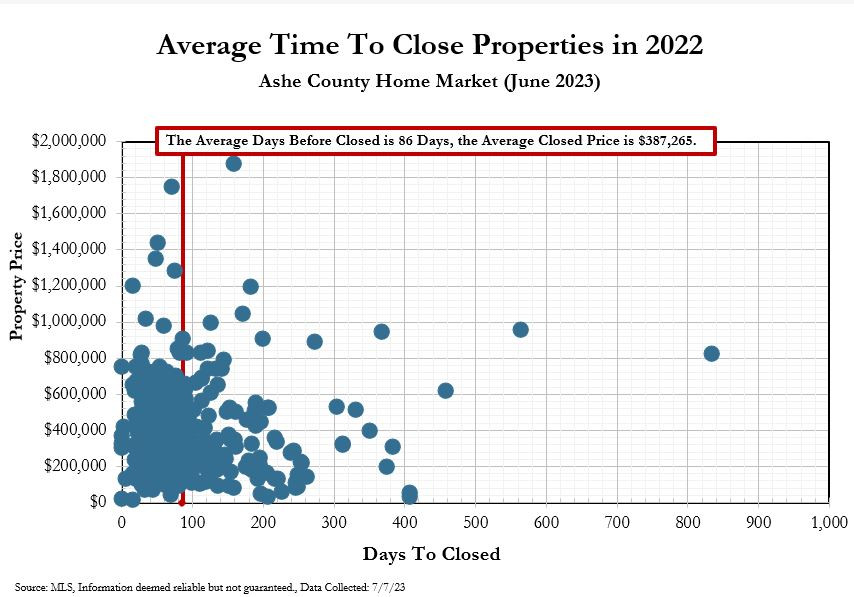

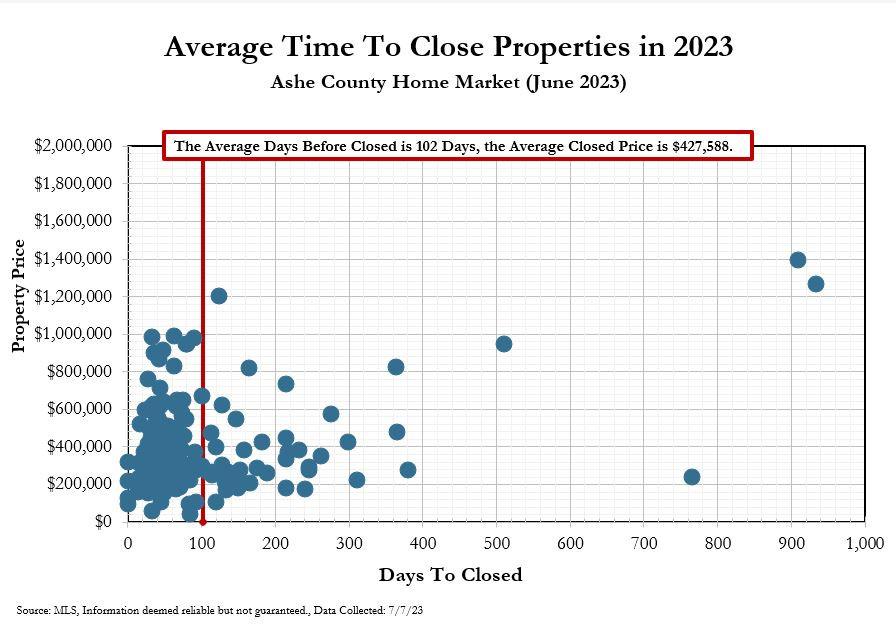

On the other hand, look at the Average Time to Close Properties graphs below for 2022 [full year] and 2023 [year to date]. Compare average prices. You’ll see the overall, for all homes, average sales price in 2022 $388K. In 2023 to date it is $428K. That seems to be a clear case that property values are NOT decreasing.

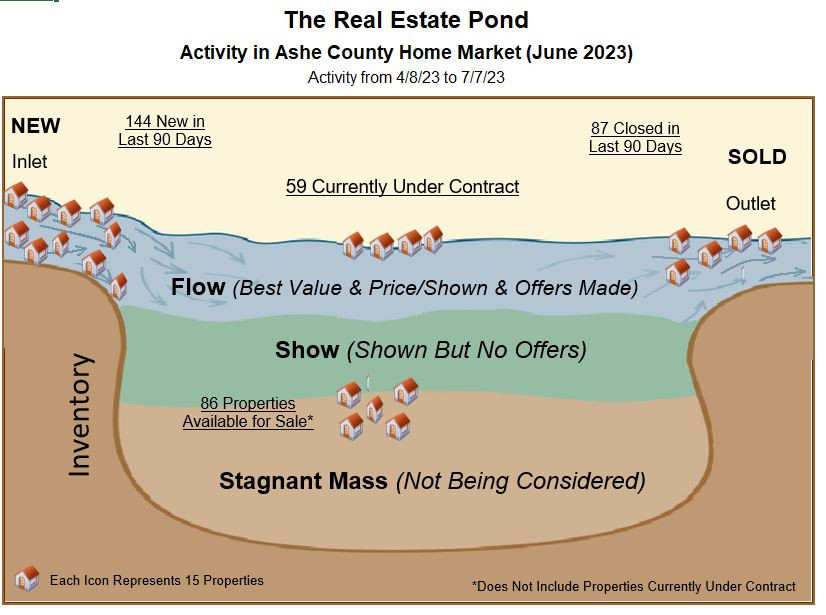

The Real Estate Pond graphs illustrate well how the market is flowing. For the first one, you’ll see 144 homes came on the market in the past 90 days, whereas 87 closed in the past 90 days. Hence, the higher inventory level: more came on than sold.

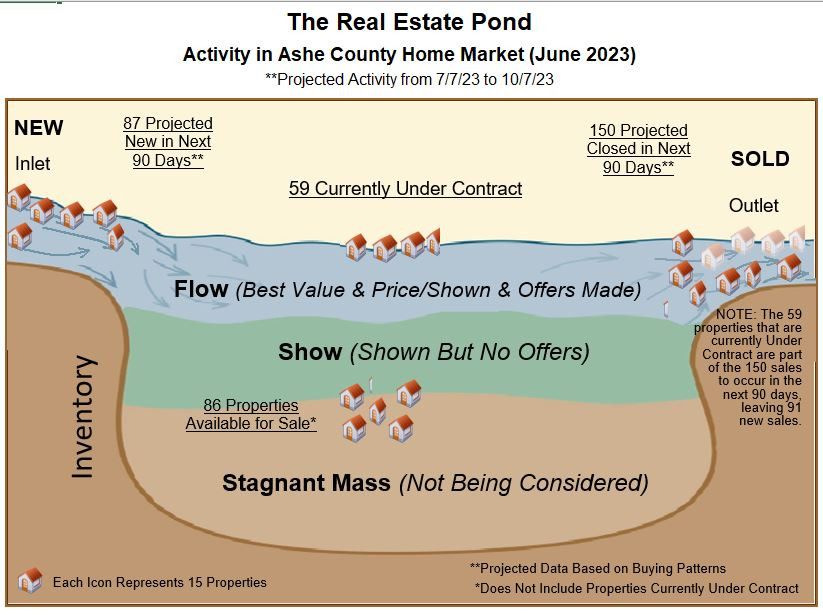

Usually, the 2nd Real Estate Pond graph is an accurate predictor of what can be expected in the NEXT 90 days. However, that graph predicts what will happen in the next 90 days based on last year’s patterns. Because less homes are selling this year, its projection for the next 90 days likely is a higher number of sales than will occur.

Wouldn’t a crystal ball be nice?! My thoughts: homes in the under $500K range may continue to sell well because there are fewer of them and more buyers for them. Except, those buyers may well be more impacted financially by the expected Fed interest rate rise to 8%. Mid-2023 it seems clear homes priced above $500K, and even more so for homes priced over $1mil, are going to take longer to sell than could be anticipated at the beginning of 2023

Final thought: The High Country is primarily a second home market. Second home markets are different than year round markets. People must buy their year round home. They don’t HAVE to buy a second home. I’m in touch regularly with realtors who work in year round markets. Homes in their markets continue to receive multiple offers; 7 days on the market before going under contract is a long time.That’s been true of a handful of homes during 2023: well-priced, in demand ‘Cream Puffs.’ For the majority homes, that has not been the case here.